Business License Tax in Vietnam

Oct. 2 – Business license tax (BLT) is an indirect tax imposed on entities that conduct business activities in Vietnam and are paid by the enterprises themselves on an annual basis.

All companies, organizations or individuals (including branches, shops and factories) and foreign investors that operate businesses in Vietnam are subject to BLT charges, and the BLT rates are different for economic entities and for households/individuals.

The amount of BLT that a business is obligated to pay is based on the amount of their registered capital (as listed on their business registration certificates) in accordance with the accompanying table below.

For state-owned enterprises, limited liability companies (LLCs) and joint stock companies (JSCs), the registered capital amount is equal to the charter capital amount. If the registered capital on the business registration certificate or investment certificate is in a foreign currency, then the registered capital amount will be converted into Vietnamese Dong in accordance with the average interbank exchange rate published by the Vietnam state bank at the time of tax calculation.

New businesses established after June 30, 2011, will only need to pay half of the BLT amount listed in the table above.

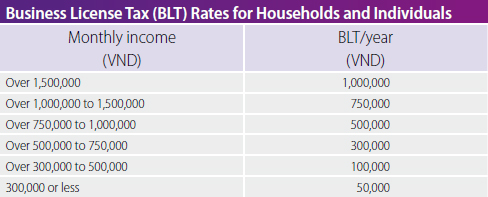

The BLT rates applicable for households and individuals conducting business in Vietnam are based on the monthly average income as follows:

Portions of this article was was taken from Vietnam Briefing’s Doing Business in Vietnam technical guide. This guide aims to assist foreign investors in understanding the business environment of Vietnam, including reasons to invest and the challenges for which to prepare for. This publication is available as a PDF download in the Asia Briefing Bookstore.

Portions of this article was was taken from Vietnam Briefing’s Doing Business in Vietnam technical guide. This guide aims to assist foreign investors in understanding the business environment of Vietnam, including reasons to invest and the challenges for which to prepare for. This publication is available as a PDF download in the Asia Briefing Bookstore.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email vietnam@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Vietnam by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Valued-added Tax in Vietnam: Filing, Payment and Refund

Calculating Value-added Tax in Vietnam

Vietnam Issues New VAT Regulations

How Foreign Contractors are Taxed in Vietnam

New Resolution to Postpone Payment of VAT and CIT

Valued-added Tax in Vietnam: Filing, Payment and Refund

- Previous Article Valued-added Tax in Vietnam: Filing, Payment and Refund

- Next Article Vietnam Seeks Indian Investment in Rubber Industry